Accelerating Impactful Insurance

Agile, Intelligent, and Seamless Insurance Operations

- Full-Stack Expertise

Challenge or Opportunity?

In a competitive insurance landscape, regulatory constraints like the 30-35% cap on management expenses can feel limiting, but it can also become an opportunity to thrive! Imagine reducing expenses and customer acquisition/retention costs while boosting customer satisfaction through personalized policy recommendations, faster claims processing, and seamless service experiences

However, a siloed data system and fragmented systems landscape is perhaps slowing you down leading to strained operations, sub-standard customer experience and lost revenues.

Today, insurers have many choices. But are they effective?

Selecting and integrating diverse tools and technologies rarely delivers lasting value.

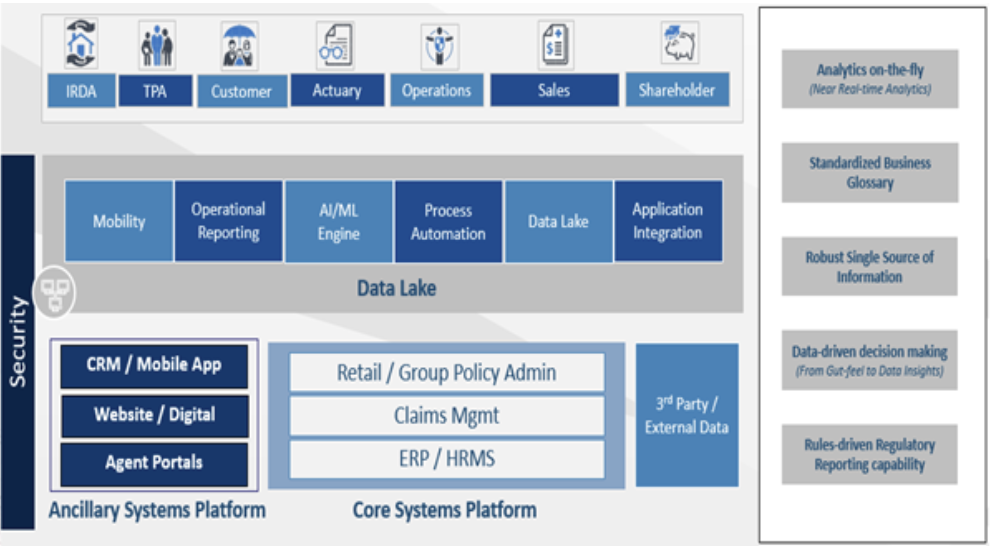

Expectation

- Highly Automated, Integrated, and Scalable platform with built-in Data Governance

- Streamlined Data Environment

- Seamless migration to Cloud/On-Premise Data Lake

- Intuitive Self-Service

Reality

- Multiple platforms or CSPs

- Difficult to keep up with evolving data requirements

- High-cost Data Lake projects

- Low value realization from AI

- Fragmented governance

- Increasing TCO

We simplify insurance with ONE unified platform that manages all your data and AI complexities!

Successful Deployments

Insurance Solutions built on mcube™

From solving reconciliation complexities, to enhancing data security through data vaults, managing seamless integrations with masters and mappers, to streamlining renewals, we’re tackling the most pressing challenges in the insurance industry — on a robust foundation of mcube™

X-ID 360

Customer Identity Management and Protection

Sales Optimizer

Track sales KPIs & operational metrics to identify areas for improvement

Other AI use cases

Diverse range includes Fraud Detection & Prevention, Risk Assessment & Underwriting, CLV Analysis, Regulatory Compliance, and more.

Our Success Stories

Our intelligent solutions help enterprises thrive in industries in which they compete.

Enabling Video-based Contact Center for one of the largest general insurance companies in India

Enabling video-based Contact Center for one of the largest general insurance companies in India

Experience being a key differentiator for the general insurance industry, the companies need to address customer grievances with great care. The general insurance companies address the grievances either by sending an agent to their customers’ locations or, in case of complaints, the customers may decide to call the contact center or visit the office.

Our client, being one of the leading general insurance companies in India, wanted to ensure that its contact center was more strategic and impactful. It wanted to leverage advanced technologies to interact more seamlessly with its customers.

Challenges:

Given the stiff competition, the consumers’ rapidly rising expectations also demanded seamless omnichannel experiences. Often the degree to which an insurance company shows empathy becomes critical in defining the customer experience. For this, face-to-face interactions were critical. However, it was often time-consuming for a customer to visit the insurance company’s office. The distance was also a challenge for many. It was also observed that, at times, unscrupulous agents interacted inappropriately with the customers and demonstrated misconduct, which resulted in customer dissatisfaction.

Solution:

To help address these challenges, TCG Digital deployed/implemented tcg mcube mobility, a video-streaming based solution for the general insurance company. It enabled the client to perform live inspections and interact with their customers remotely. It also enabled them to gauge the customer sentiment in real-time. All video sessions could be saved with geo-location and timestamp for future reference. Necessary still-pictures could also be taken as per the requirement.

Additionally, the platform enabled self-inspection, where the customer could engage in live video chats through a browser-based interface with a contact center agent. A URL would be sent to the policy holder on runtime through a text message from tcg mcube mobility. The customer would then just click on it using a smart phone and chat seamlessly with an agent over video.

Benefits / Impacts:

- The customer of the general insurance company did not have to pay visits to the office in-person, which saved both time and money

- Clear and concise conversations were made possible through video chats, which helped build a rapport and improved customer interactions

- The insurance company could manage agent activities more effectively, improving the claims process, increasing conversion rates, and enhancing the overall service quality

- The insurance company could save the cost of sending an agent to the spot, which in turn, helped lower the total cost of claims processing

Addressing Challenges related to Agricultural Insurance for a well-known insurance company in India

Addressing challenges related to Agricultural Insurance for a well-known insurance company in India

Objectives:

With increasing competition in the agricultural insurance market, there is a growing need for innovation and improved customer service. The client wanted to harness the potential of evolving technologies to compensate farmers’ losses timely and improve the claims process.

Challenges:

The agricultural land/field was located away from the city, and for a surveyor to pay an in-person visit for inspection was time-consuming. As a result, after an incident being reported manually, the process of disbursing the money was taking longer than usual. This was resulting in customer dissatisfaction and a potential revenue loss for the company.

Solution:

TCG Digital helped the insurance company to deploy mcube mobility, a video-streaming solution, which enabled the surveyor to undertake inspections remotely without the need of visiting the field. This mobile device app was also provided to the local workforce and integrated with the core system of the general insurance company. The features of the app enabled the field-person to connect with the general insurance company through live-video streaming in cases of losses caused by bad weather. Inspections were performed in real-time and necessary decisions were taken. All video sessions were saved with timestamp and geo-location for future reference.

Moreover, as the concerned area was out of network coverage, mcube mobility’s offline option proved useful. It enabled seamless inspections despite the unavailability of the network and accelerated the claims process.

Benefits / Impacts:

With mcube mobility, the client could

- Engage in effective decision-making

- Generate compliance reports without delay

- Reduce the usual time it took to disburse the claim amount

Enabling Renewal Optimization for one of the largest insurance companies

Enabling Renewal Optimization for one of the largest insurance companies

For most players, renewal remains the primary source of revenue. Besides, it is the quality of the claim experience that decides the subsequent behavior of the policyholder.

For instance, a particular general insurance company was interested in clients who were likely to renew their policies. With an aim to maximize the number of renewals, here is how TCG Digital enabled the general insurance company to assess the risk that clients making late premium payments were facing and basis that develop an incentive plan for sales agents to maximize the total net revenue.

Challenges:

In a challenging economic environment with stagnating growth, customer retention and timely renewal of policies remain the key areas of concerns. The insurance company was experiencing mid-term cancellations, late premium payments, and also losing customers to its competitors. All of these were leading to a decrease in profitability.

Solution:

TCG Digital suggested a renewal propensity model (ML Model) to the client. The insurance company could then use advanced analytics to profile customers into high, medium, and low risk segments by applying algorithms such as Decision Trees, Random Forest, XG Boost, or Logistic Regression and also identify policyholders who were likely to go for renewal. This also helped them to concentrate on the target clients who were at high risk of non-renewal well in time. Furthermore, we provided the company with a retention plan to win back churned clients.

Benefits / Impacts:

- This model allowed the insurance company to calculate the potential total net revenue from a group of renewed clients.

- The company was able to identify high-risk customers and increase customer retention by 2%.

- The client made effective use of the model to formulate a strategic plan for its sales agents to increase renewal collection and gauge profitability trends in the long run.

Facilitating Cross-Sell/Up-Sell for a well-known Indian insurance company

Facilitating Cross-Sell/Up-Sell for a well-known Indian insurance company

Cross-selling occurs across all industries and at both the wholesale and retail levels. Selling additional products to an existing customer is usually much easier than acquiring a new customer to sell to. It’s a widely recognized fact that consumers tend to make repeat purchases from the same businesses they’ve traded with in the past. Similarly, in the insurance industry cross-sells are considered one of the best and easiest methods of generating additional revenues for a business.

Challenges:

In addition to generating more income, cross-selling may also carry the advantage of strengthening customer relationships. However, if the cross-sold product or service doesn’t enhance the value of the customer’s primary purchase, then a cross-sell may end up damaging rather than strengthening a company’s relationship with the customer.

Solution:

TCG Digital empowered the insurance company with predictive analytics, which enabled it to profile its customers and target those interested in additional products. This helped increase its revenue as well as strengthen the company’s relationship with its customers.

We cleaned the data and then aggregated information about its customers in the database to derive their historical purchase patterns, and then applied algorithms like Decision Trees or Logistic Regression to train the predictive models. After that, the models were able to separate the customer base into ‘interested’ and ‘not interested’ profiles. This helped the insurance company significantly by allowing it to make more efficient and successful use of cross/upsell.

Benefits / Impacts:

- Identification of base and target products.

- Helped the company in cross selling the right policies to the right customers.

- Efficient use of cross/upsell led to improving the profitability and lowering the price.

- This technique became the company’s personal selling advantage, which also differentiated it from its competitors.

- This strengthened the customer relationship with its existing customers as the client was able to target the right customers from its database and provide them with their need-based products. Given a healthy relationship, the insurance company also witnessed an increase in quality leads.

Automating Statutory and Regulatory Reporting for one of the leading general insurance companies

Automating Statutory and Regulatory Reporting for one of the leading general insurance companies

In insurance, statutory and regulatory reporting takes up a major share of the insurers’ time, money, and effort when dealing with different departments like the actuaries, finance, claims, operations, etc. The norms related to the reporting are governed by the Insurance Regulatory and Development Authority of India (IRDAI) are stringent and must be compiled in a proper and timely manner, failing which may leave a major impact on the companies.

TCG Digital aimed to provide a fully automated statutory and regulatory reporting framework to the client.

Challenges:

Our client, being one of the leading general insurance companies in India, was facing issues pertaining to compliance, data quality, and timely delivery. These were related to statutory reporting and the client wanted to automate the entire process.

Solution:

TCG Digital provided the client with an automation solution for the end-to-end statutory reporting process, which spanned across almost fifty departments. Starting from collecting, cleaning, validating the data to structuring the report as per prescribed formats; the model enabled it all. It ensured timely and hassle-free delivery while eliminating manual intervention.

TCG Digital also provided visualization options for these reports on its tcg mcube platform, which was very easy to access and provided better insights to various stakeholders. Simultaneously, it enabled the client to send out email embedded report snapshots.

Benefits / Impacts:

- Reduced manual effort, thus, helping the company to make optimal utilization of resources.

- Automation ensured hassle-free and timely delivery of reports.

- Error in data was almost negligible due to data cleaning and data validation.

- Reconciliation of numbers across various reports.

- Proper compliance with IRDAI.

- Better visualization of reports for senior management and other stakeholders to gauge company performance.

How mcube™ mobility helped a general insurance company to deliver superior Customer Experience

How mcube mobility helped a general insurance company to deliver superior Customer Experience

Objectives:

The client, a well-known general insurance company, realized the importance of tapping into the potential of emerging technologies and ensuring customers a quick and hassle-free claim settlement process. This decision was important for retaining existing customers and acquiring new ones. The general insurance company wanted to:

- Start differentiating by enhancing the quality of products and services they were offering

- Process claims quickly while managing risks and comply with regulatory requirements

- Harness the potential of data to deliver better customer service

To address the above objectives, the insurer decided to collaborate with TCG Digital and leverage our advanced capabilities in mobility.

Challenges:

In trying to optimize the insurance lifecycle, the insurance company witnessed a host of challenges:

- Getting an appointment with a surveyor was time-taking

- From the time an incident was reported till disbursement of money, it took an average of three days

- Space in the workshop remained occupied till the vehicle was repaired

Why TCG Digital:

TCG Digital intervened and proposed mcube mobility, a video streaming-based solution to the client. mcube mobility has been designed to help insurers meet their future needs. The features in the solution work together to strengthen an insurer’s ability to engage with their employees, customers, and agents better.

In this particular case, the solution enabled:

- Hassle-free communication: The mobile-based app was provided to the workshop and integrated with the core system of the general insurance company. Through live video streaming, the workshop could connect to the surveyor who performed inspections in real-time without visiting the workshop. This enabled accurate and timely decisions.

- Archiving of video sessions: All video sessions were saved with geo-location and timestamp for future reference. Necessary still-pictures could also be taken when required.

- Self-Inspection: Additionally, the app enabled self-inspection where the vehicle owner could perform the same inspection through a browser-based interface. The URL for claims process was sent to the vehicle owner on runtime through a text message.

Business Value/Project Impact:

Within a short span of time, the client witnessed incredible results, which can be summed up as:

- Enhanced customer convenience through anytime anywhere insurance app

- Time taken to disburse the claim amount reduced from 3 days to 30 minutes

- Significant cost and time savings, which improved operational efficiency

- The workshops could start repairs without delay, release the vehicle and attend to new cases

The outcome resulted in better customer experience, satisfied employees, and increased business volume.