Insurance solution

Our solution

In consideration of the given challenges, TCG Digital provides several data analytics offerings for the insurance domain.

- Analysis of Loss and Combined Ratio – Tracks loss ratios across various dimensions for taking action for clusters with high loss ratios. Profitability is tracked by geography, by product, and by channel. This provides actionable insights that help in interventions for improving the loss ratio.

- Fraud Analytics – Uses statistical methods and advanced analytics to identify abusive claims or padded claims for cost anomalies. It can also be used to identify the drivers through which most fraudulent cases have been registered. Clustering can be drawn upon to identify existing, fraudulent cases.

- Analytics on External Data – Uses analytics-driven quotations enhanced with Aadhaar details and Social Media data (external data). This improves the customer experience since they are given realistic quotes. It also reduces TAT and improves the customer experience; resulting in increased acquisition.

- Actuarial Analytics – Provides insights into risk exposure and adequacy reserves by generating loss triangles for actuarial analytics. Performance insights can be created across multiple dimensions by analyzing: cumulative statement of claims, salvage, subrogation recoveries, and reserve utilization.

- Claim Incidence & Severity Analytics – Allows one to assess the risk profile of the book of business and to predict the expected claim incidences and severity over a specified time horizon. The analysis is based on such attributes as demographics, industry trends, etc. This helps in assessing the exposure and in proactive planning.

- Underwriting Profitability – Leverages portfolio analytics to understand the risk and to hedge all emerging threats proactively. This is critical for underwriting profitability. Reporting is done across various LOB, product towers, and locations to understand underwriting profits and to provide suggestions to improve the analysis.

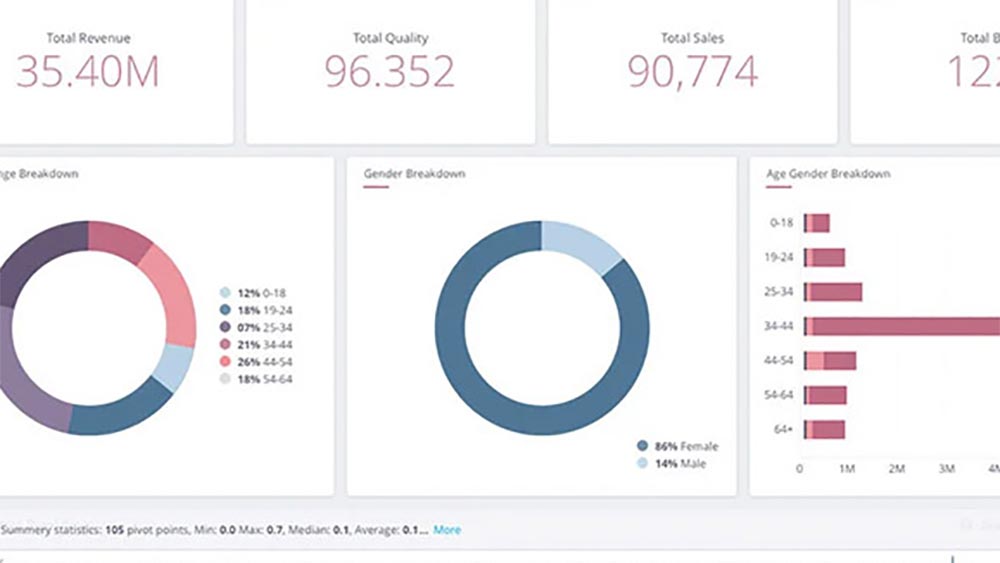

- Customer Analytics – Enables prediction of life-time value; deciphers the profitability of a customer. This can be derived from: their past history of payments, time of payment, defaults, and claims. Churn prediction for customers and recommendation of preventive intervention steps are based on: profile, life cycle stage, and recent history of events.

- 360 degree Customer View – Assists data quality and standardization across data bases to develop single-customer view across channels, products, and markets for better targeting. Enables a 360 degree view of the customer; categorizes and presents all touch-points and case histories to empower customer agents.

- Case Reserving – Helps improve the quality and the consistency of case reserving in order to be prepared for volatility. It also eliminates chances of higher pay-outs or skewed long-term, actuarial projections.

- Sales Funnel Analysis – Analyses the conversion from quote, to proposal, to contract, by products and by channels. This helps identify improvement areas and provides proactive suggestions based on historical data. Thus, conversion rates are improved and customer acquisition costs are reduced.

Implementation spanned the following areas :

- Creation of a data lake

- Automation of the Claims OS Register

- Creation of common reinsurance data mart; along with relevant dashboards

- Provision of analytics for campaign management

- Analytics for the Bancassurance team

- Generation of consolidated data and computations related to claims and premium for the actuarial team

- Other on-going initiatives

Challenge

The emergence and apparent convergence of evolving digital technologies are enabling insurance companies to provide high-touch, on-demand personalized experiences to a new generation of insurance customers. This new experience requires transformation operations, actuarial, underwriting, sales and even financial processes to provide a seamless experience. Every process is being driven by data and involves immense artificial intelligence and machine learning capabilities.

- Data size is too large to be handled in MS Excel

- Manual reporting

- Multiple mapping files

- Data not handled at policy level

Challenge

The organization has two core systems S3 and GC. This data is used to populate SAP through staging tables. Data in SAP does not match the data in S3 and GC and it is imperative to understand in which stage data drops. This is where a data lake can be an important and a single source of truth for reconciliation mechanisms. Other challenges include :

- Data size is too large to be handled in MS Excel

- Manual reporting

- Multiple mapping files

- Data not handled at policy level